-

2023-05-18 May 25, 2023 Spring Seminar - Speech given by Jones Chou, Chairman of Jepun Group

May 25, 2023 Spring Seminar - Speech given by Jones Chou, Chairman of Jepun Group

Title : Green Financial Technology: Trends and Business Opportunities of Financial Digital Transformation

Time : 12:10-13:30, May 25, 2023

Presentation room: 3F13

post date:2023-05-25 22:04:14

-

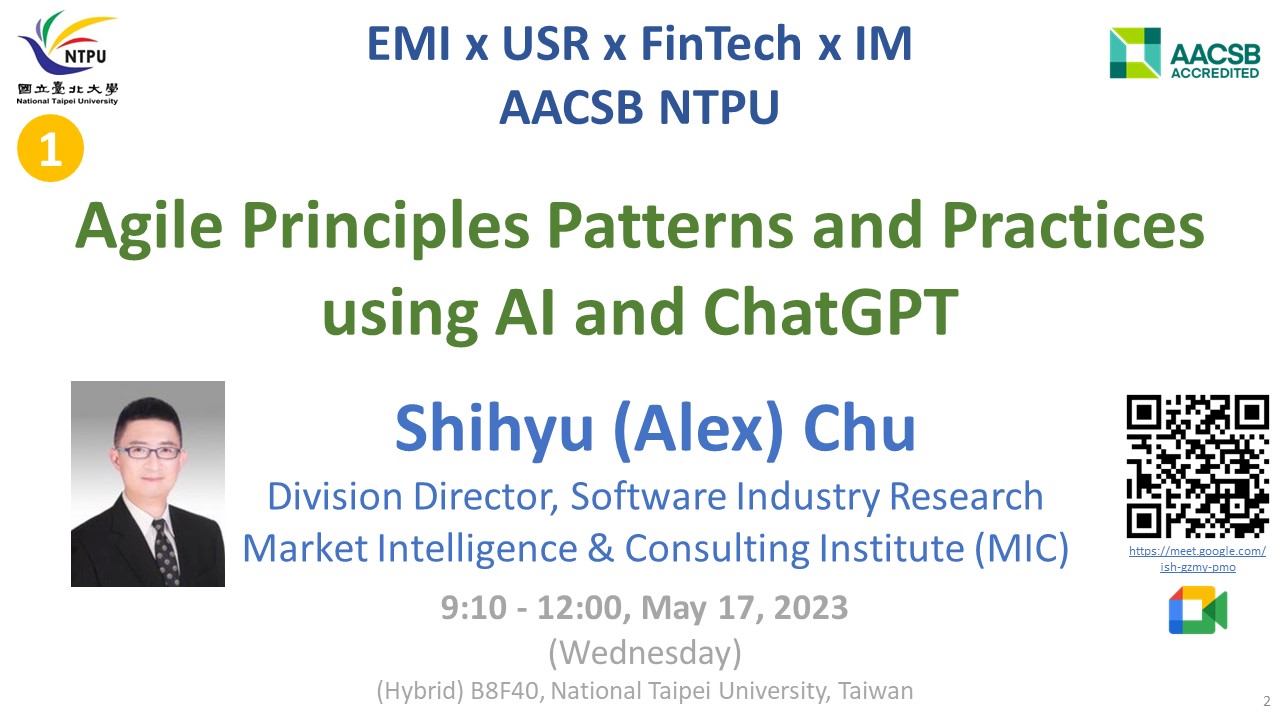

2023-05-10 May 17, 2023 Spring Seminar - Speech given by Division Director Shihyu (Alex) Chu, Software Industry Research

May 17, 2023 Spring Seminar - Speech given by Division Director Shihyu (Alex) Chu, Software Industry Research

Title : Agile Principles Patterns and Practices using AI and ChatGPT

Presentation date : 9:10-12:00, May 17, 2023

Link : https://meet.google.com/ish-gzmy-pmo

post date:2023-05-25 22:09:52

-

2023-05-10 May 17, 2023 Spring Seminar - Speech given by Division Director Shihyu (Alex) Chu, Software Industry Research

May 17, 2023 Spring Seminar - Speech given by Division Director Shihyu (Alex) Chu, Software Industry Research

Title : International Carbon Neutral Industry Trends and Digital Transformation for Sustainable Development

Presentation date : 12:10-13:00, May 17, 2023

Link : https://meet.google.com/paj-zhhj-mya

post date:2023-05-25 22:09:14

-

2022-12-20 December 22, 2022 Winter Seminar - Speech given by Prof. Chih-Yung Lin, National Yang Ming Chiao Tung University

December 22, 2022 Winter Seminar - Speech given by Prof. Chih-Yung Lin, National Yang Ming Chiao Tung University

Presentation date: 15:10-17:00, December 22nd, 2022

Presentation room: 7F02

Speaker: Chih-Yung Lin

Professor of Finance

Department of Information Management and Finance

National Yang Ming Chiao Tung University

Title: Overconfident Customers and Supplier Firm Value

Abstract:

This paper examines whether the overconfidence of a downstream customer firm’s CEO affects the value of its upstream supplier firms. We find that CEO overconfidence positively influences investor opinion regarding upstream supplier firm value. Further examination of potential mechanisms shows that higher valuation is more prominent when overconfident customer firms invest more and be innovative. The value-enhancing effect is easier to spill over to investors when the supplier has a more transparent information environment. We show that the positive relation is causal and robust using exogenous variations from death, illness, and retirement of the CEO and from a crisis shock. Overall, our findings suggest that serving overconfident customers benefits shareholders by improving investor recognition and gaining a positive spillover effect from customer firms’ aggressive search for growth opportunities.

JEL: G32, G34, G41, M14, Q51

Key words: CEO overconfidence; supply chains; firm value; investor recognition effect; R&D intensity.

post date:2022-12-20 16:14:17

-

2022-12-08 December 14, 2022 Winter Seminar - Speech given by Prof. Chi-Yang Tsou, University of Manchester

December 14, 2022 Winter Seminar - Speech given by Prof. Chi-Yang Tsou, University of Manchester

Presentation date: 13:10-15:00, December 14th, 2022

Presentation room: 4F03 (Fintech and Green Finance Center)

Speaker: Chi-Yang Tsou

https://sites.google.com/view/chiyangtsou/home

Assistant professor

Division of Accounting and Finance

Alliance Manchester Business School

University of Manchester

Title:

Pollution Abatement Investment under Financial Frictions and Policy Uncertainty

Abstract:

This paper examines how firms' investments in pollution abatement are influenced by financial frictions and policy uncertainty. Our data analyses suggest that financially constrained firms are less likely to invest in pollution abatement and are more likely to release toxic pollutants. Such a pattern is intensified by policy uncertainty measured by close gubernatorial elections. We then develop a heterogeneous firm model in which financially constrained firms to face increased shadow costs of finance from pollution abatement. This relation is further amplified by policy uncertainty for environmental regulation, which further reduces firms' incentives with respect to pollution prevention. Our empirical evidence and model suggest that the effectiveness of environmental policies is subject to corporate financial frictions and policy uncertainty.

post date:2022-12-08 22:01:21

-

2022-12-08 December 15, 2022 Winter Seminar - Speech given by Assistant Vice President Yu-Hong Chen, Yuanta Futures

December 15, 2022 Winter Seminar - Speech given by Assistant Vice President Yu-Hong Chen, Yuanta Futures

Presentation date: 14:00-16:00, December 15th, 2022

Presentation room: 7F02, College of Business

Speaker: Assistant Vice President Yu-Hong Chen From the Yuanta Futures

Title: Introduction to the Application of Business in Futures Proprietary Merchant

Abstract:

- Evolution of Trading Strategies

- Spread strategy

- Market Making Strategies

- Arbitrage Strategy(PCP、ETF)

- Trend Strategy(Option Volatility)

- Quantitative Model Strategy Development

- Trading Strategy System Development

- Other Research (Machine Learning Cases)

post date:2022-12-08 22:02:23

-

2022-12-08 December 21, 2022 Winter Seminar - Speech given by Prof. Tim C.C. Hung, National Taiwan University

December 21, 2022 Winter Seminar - Speech given by Prof. Tim C.C. Hung, National Taiwan University

Presentation date: 13:10-15:00, December 21st, 2022

Presentation room: 4F03 (Fintech and Green Finance Center)

Speaker: Tim C.C. Hung

https://sites.google.com/view/timcchung

Assistant Professor of Finance

Department of Finance

National Taiwan University

Title: Market Returns and a Tale of Two Types of Attention

Abstract:

Daily aggregate retail attention to stocks (ARA) negatively predicts the one-week-ahead market returns, whereas aggregate institutional attention (AIA) positively predicts market returns around scheduled major news announcements. Results hold out of sample with meaningful expected utility gains, and the effect of ARA is causal. Cross-sectionally, ARA's predictability is stronger for illiquid stocks, while AIA's predictability is higher for high-beta stocks. The findings suggest that attention-driven retail buying generates marketwide price pressure that quickly reverses, whereas institutional attention precedes systematic resolution of uncertainty and the accrual of risk premiums.

post date:2022-12-08 22:04:56

-

2022-12-08 December 22, 2022 Winter Seminar - Speech given by Prof. Tse-Chun Lin, University of Hong Kong

December 22, 2022 Winter Seminar - Speech given by Prof. Tse-Chun Lin, University of Hong Kong

Presentation date: 13:10-15:00, December 22nd, 2022

Presentation room: 7F02

Speaker: Tse-Chun Lin

https://www.hkubs.hku.hk/people/tse-chun-lin/

Professor of Finance/Area Head of Finance,

HKU Business School,

University of Hong Kong

Title: In Victory or Defeat: Consumption Responses to Wealth Shocks

Abstract:

Using a novel representative sample of digital payment data, we observe a robust U-shaped relationship between individual investors’ monthly entertainment-related consumption and stock market returns in the previous month. Contrary to the prediction of the wealth effect, individuals increase their entertainment-related consumption after experiencing large positive and negative stock market shocks. We show that the latter effect, termed “financial retail therapy,” is consistent with a dynamic model of Prospect Theory, and provide further evidence for it in a controlled laboratory experiment. Finally, we show that our results are not driven by income effects or wealth shock measurement errors.

post date:2022-12-08 22:10:37

-

2022-03-21 May 18, 2022 Summer Seminar - Speech given by Prof. Shih-wei Liao, National Taiwan University

May 18, 2022 Summer Seminar - Speech given by Prof. Shih-wei Liao, National Taiwan University

The Center and the Bilingual Education Office,NTPU plan to jointly invite Professor Shih-wei Liao from the National Taiwan University to give a speech, and the relevant information is as follows:

Time: Wednesday, May 18, 2022 12:10~13:00

Venu: 313, 3rd Floor, College of Business

Speaker: Shih-wei Liao (NTU, Department of Computer Science and Information Engineering, Professor)

Topic: Web 3: From DeFi to WoFi

post date:2022-12-08 22:08:47

-

2022-03-17 March 23, 2022 Spring Seminar - Speech given by Prof. Tse-Chun Lin, University of Hong Kong

March 23, 2022 Spring Seminar - Speech given by Prof. Tse-Chun Lin, University of Hong Kong

The Center and the Department of Business Administration plan to jointly invite Professor Lin Zejun from the University of Hong Kong to give a keynote speech, and the relevant information is as follows:

Time: Wednesday, March 23, 2022 11:00~12:00

Venu: 313, 3rd Floor, College of Business

Speaker: Tse-Chun Lin (Area Head of Finance, Professor)

Topic: The Unintended Externalities of an Environmental Regulation: Evidence from the NOx Budget Trading Program

post date:2022-12-08 22:08:02

-

2022-03-14 March 16, 2022 Spring Seminar - Speech given by Prof. Tse-Chun Lin, University of Hong Kong

March 16, 2022 Spring Seminar - Speech given by Prof. Tse-Chun Lin, University of Hong Kong

The Center plan to jointly invite Professor Lin Zejun from the University of Hong Kong to give a keynote speech, and the relevant information is as follows:

Time: Wednesday, March 16, 2022 12:10~13:30

Venu: 403, 4th Floor, College of Business

Speaker: Tse-Chun Lin (Area Head of Finance, Professor)

Topic: Is Charity Immune to the Covid-19 Pandemic? Large-scale Evidence from Online Charitable Loans

post date:2022-12-08 22:08:59