【Call for Paper】2023 Global Corporate Sustainability Forum (2023 GCSF)

【Call for Paper】2023 Global Corporate Sustainability Forum (2023 GCSF)

2023 Global Corporate Sustainability Forum (2023 GCSF)

Accelerating Transition in Global Change

November 16, 2023

The Grand Hotel, Taipei, Taiwan (R.O.C)

“2023 Global Corporate Sustainability Forum (2023 GCSF)” will be held in Taipei, Taiwan on November 16, 2023. It represents a valuable occasion to discuss opportunities and challenges in corporate sustainability by bringing together practical and academic communities around the world. The theme of 2023 GCSF, “Accelerating Transition in Global Change”, aims to lead business managers to the goal of being environmental-friendly.

The 2023 GCSF warmly welcomes all the participants of the event. The speakers will share their researches, approaches and innovative ideas on the concept and practice of corporate sustainability. We hope that the 2023 GCSF will provide a contribution to advancing and disseminating practical and effective strategies and solutions to build a sustainable world.

Call for Paper

You can submit a manuscript for an oral presentation in one of the following topics. Submissions must be in English; 2023 GCSF will be held in English completely. Abstracts and manuscripts will be published in proceedings. Selected papers will also be forwarded for publication in the special issue – “Inclusiveness, Innovation, and Investment” – of Journal of Business Administration (JBA, ISSN: 1025-9627), which is indexed in EconLit, EBSCO, ABI/INFORM and ProQuest. 2023 GCSF aims to have a positive impact on the search for sustainable solutions through the following main topics:

Corporate sustainability

Socially responsible investing (SRI)

Social return on investment (SROI)

Task force on climate-related financial disclosures (TCFD)

Big data and corporate sustainability

Internet of things (IoT) and corporate sustainability

Artificial intelligence (AI) and corporate sustainability

Circular economy and corporate sustainability

Corporate social responsibility (CSR) and performance

Economic sustainability on banking and finance

Global strategies in corporate sustainability

Green innovation. Green marketing

Green production. Green design

Green finance. Green accounting

Green supply chain management

Energy, resource, waste, and environmental policy, planning & management

Entrepreneurship management and sustainable development

Corporate sustainability and competitive strategies

Clean development mechanism and carbon emission reduction

Renewable energy policy and planning

Climate change and environmental economics

Submission Formatting

Please follow the APA (American Psychological Association) formatting and citation guide. In addition, the authors should refer to the following submission formatting guidelines.

A4 size paper. Single line space. Margins: 2.54 cm on the left and 2.54 cm on the right. Align left. No footers and headers allowed.

Fonts

Title: Times New Roman 14 bold.

Subtitles: Times New Roman 12 bold.

Text: Times New Roman 12.

First page (title page): Title of manuscript. Name(s) of author(s). Affiliation(s) of the author(s). E-mail address(es) of the author(s).

Second page: Abstract of maximum 300 words. Key words of maximum 5 words (under abstract).

Paper page limit: 20 pages, including all figures, tables and references.

Submission Email

gcsf.submission@gmail.com (.pdf, .doc or .docx)

If you have any question, please kindly reply to this email to let us know.

Hosting Organization

2023 GCSF is organized by the College of Business at National Taipei University and Taiwan Institute for Sustainable Energy (TAISE).

Venue

The Grand Hotel Taipei

No.1, Sec. 4, Zhongshan North Rd., Zhongshan Dist., Taipei 10461, Taiwan (R.O.C.)

Important Dates

Full Paper Submission Deadline: September 15, 2023

Date of Acceptance Notification: October 2, 2023

2023 GCSF: November 16, 2023

Registration Fee

Registration fee of 2023 GCSF is free for all presenters and participants on November 16, 2023. (No meal service)

contact:

tel:

date:2023-08-14 11:43:58

file:file1

National Taipei University releases the “2020 Taiwan Sustainable Investment Survey” that is connected with global trends.

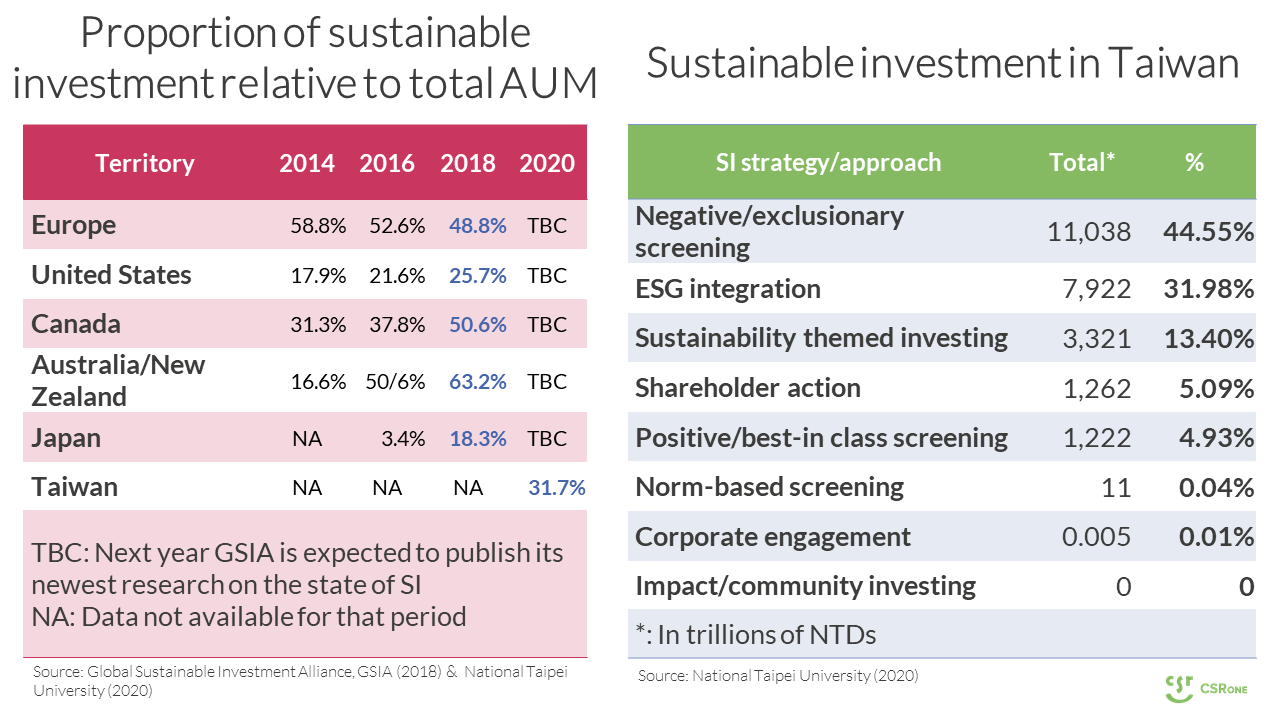

Following the release of the summary report at the end of last year, the College of Business Center for Corporate Sustainability officially released the full text of the latest "Taiwan Sustainable Investment Survey". The survey found that the current sustainable investment assets in Taiwan are about NT$1.3 trillion, of which nearly 80% adopt "negative/exclusive stock selection." Plus, the overall investor response rate is 60%; hence, the increase on the rate is expected.

Hard hit by the COVID-19 epidemic, the global financial market fluctuated violently in 2020. However, various research and investment markets have shown that companies or related funds that perform well in "sustainability" have relatively outstanding performance in all aspects. In order to grasp the performance of Taiwanese institutional investors in sustainable investment, organized by the National Taipei University Center for Corporate Sustainability and sponsored by Cathay Financial Holdings, the "Taiwan Sustainability Investment Survey" was conducted to understand the current situation of Taiwan's sustainable investment through questionnaires.

99 institutional investors from Taiwan are invited to participate the survey, including 26 insurance companies, 59 securities investment trust and consulting companies, and four government funds. Furthermore, the Financial Supervisory Commission Republic of China (Taiwan), the Taiwan Stock Exchange Corporation and associations assist in communicating with institutional investors. Of all questionnaires, 59 valid ones were recovered and 37 companies provided the amount of assets for sustainable investment.

The survey results revealed that the share of SRI in AUM is 31.7% in Taiwan. The insurance industry accounts for NT$12 trillion, government funds account for NT$1 trillion, and securities investment trust and consulting companies account for NT$0.6 trillion. The team explained that the relatively small amount of sustainable investment by securities investment trust and consulting companies appears to be related to their less willingness to fill their sustainable assets. In the future, the team will communicate with these companies, hoping that the survey results will reflect Taiwan sustainable investment practices.

In terms of investment management methods, referring to the definition of sustainable investment by various promotion agencies including GSIA (Global Sustainable Investment Alliance), the research team categorized the methods into 8 different groups. They are negative/exclusionary screening, positive/best-in-class screening, norms-based screening, ESG integration, sustainability-themed investment, impact investing, exercising voting rights, and engagement & shareholder proposals. According to statistics, nearly 80% of investment adopts the negative/exclusionary screening, the trend that is consistent with international trend of sustainable investment.

Although the negative/exclusionary screening is the most common method, the research team regards it as a more passive method. It is recommended that institutional investors adopt ESG integration and sustainable themed investments when developing their own sustainable investment strategies. More active and linked to financial performance, these methods not only help create win-win investment results for financial performance and ESG performance, but are in line with the sustainable investment trend in North America.

Although the negative/exclusionary screening is the most common method, the research team regards it as a more passive method. It is recommended that institutional investors adopt ESG integration and sustainable themed investments when developing their own sustainable investment strategies. More active and linked to financial performance, these methods not only help create win-win investment results for financial performance and ESG performance, but are in line with the sustainable investment trend in North America.

The host of the team, Professor Chi-Jui Huang of the Department of Finance and Cooperative Management, said that this research was carried out in line with the FSC Green Finance Action Plan 2.0 and Corporate Governance 3.0 policies, and was conducted in a method recognized by international institutions. The results of the research can be used by domestic and international stakeholders who are interested in sustainable investment of Taiwan. He predicted that in the future, the team will also follow up surveys every year and release research reports regularly, looking forward to promoting the steady and positive development of Taiwan's sustainable investment, and working with relevant institutions to create a friendly environment for Taiwan's sustainable investment.

The full text of the research report has been published on the website of the College of Business Center for Corporate Sustainability, NTPU. Those who are interested in Taiwan's sustainable investment are welcome to download it.

contact:Research assistant of Center for Corporate Sustainability Meng-Ju, Kao

tel:(+886)2 26741111#66410

date:2021-04-19 16:45:51

Sustainable investing is changing global supply chains: 4 key takeaways

Sustainable investing is changing global supply chains: 4 key takeaways | Greenbiz

contact:

tel:

date:2021-02-01 11:51:37

Increased investment value the local "Taiwan Sustainability Value Index" on the international version

The National Taiwan Sustainability Index (TWNSI) was jointly constructed by the University of Taipei and the Taiwan Sustainable Energy Research Foundation (TWNSI) at the Shin Kong Life Insurance New Board Building in New Taipei City yesterday (23). It was announced on January 19. With the calculation and assistance of the German index company Solactive platform, it was officially launched on Reuters and Bloomberg at the same time.

In his speech, Jian Youxin, Chairman of the Taiwan Sustainable Energy Research Foundation, said that Social Responsible Investment (SRI) and the emphasis on corporate ESG performance have become a global trend. By the end of 2016, the global investment was approximately US$22.8 trillion, of which Europe accounted for 52.6 %, the United States accounts for 38.1%, and Japan accounts for about 2.1%. Taiwan is still in its infancy and accounts for less than one in ten thousand, and there is still a lot of room for growth.

Li Chengjia, President of National Taipei University, stated that Taipei University and the Taiwan Sustainable Energy Research Foundation will work together to construct the local "Taiwan Sustainable Value Index". This (1) 19th was officially launched on Reuters and Bloomberg with the assistance of the German index company Solactive platform. The launch, which demonstrates the long-term efforts of the school's business school to focus on sustainable corporate teaching and research characteristics, and believes that it can exert an innovative and positive social influence on Taiwan's financial market.

In recent years, Socially Responsible Investment (SRI) has become an important mainstream trend that global institutional investors pay attention to. The scale of assets invested in SRI has reached approximately 25% of the global total fund assets. Zhan Chang, director of the Business Sustainability Research Center of Taipei University Business School, who is the lead member of the TWNSI preparation team, said that Asian countries except Japan accounted for only 0.2% of the world’s SRIs. Emphasizing socially responsible investment is the goal of Taiwan’s social efforts, and SRI representatives are also evident Business opportunities in the future financial market.

Director Zhan also said that TWNSI selects constituent stocks from the perspective of sustainability, which effectively reduces investment risks and increases return on investment; TWNSI currently has 40 constituent stocks accounting for 46.34% of the overall market, and the top 14 constituent stocks have been in the past three years. It was selected as one of TCSA's top ten sustainable model enterprises. Director Zhan said that the four major funds in Taiwan invest in Taiwan stocks and estimate that socially responsible investment is more than NT$ trillion, and there will be 5 to 10 times growth in the future.

contact:

tel:

date:2021-02-01 11:52:47